1825

1825

2018-01-29

2018-01-29

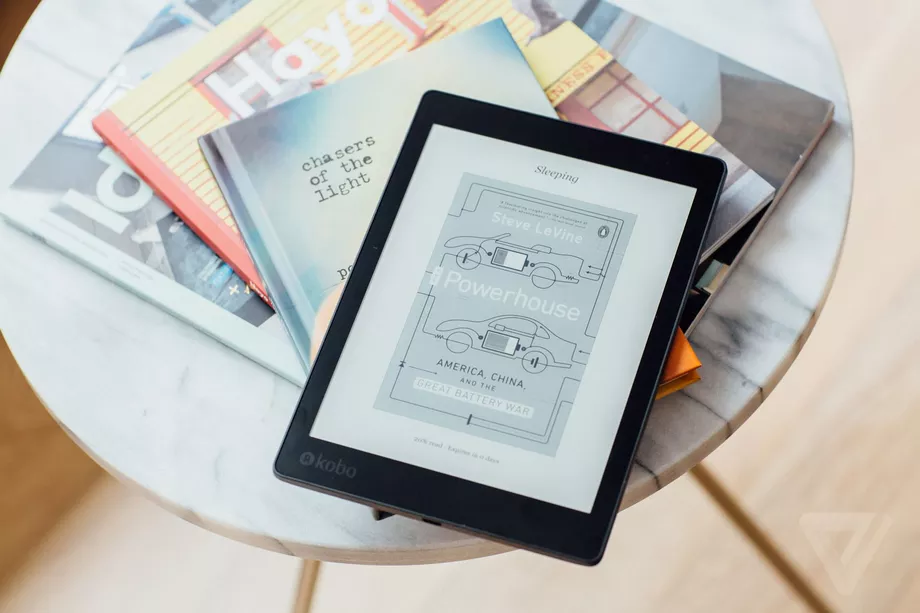

This past week, Walmart announced a deal to sell e-books and e-book reading devices from Kobo, a major player in the global e-book market that had all but given up on the U.S. a few years ago. And Bloomberg reported that Apple is preparing a major revamp of its iBooks e-book platform for iOS devices and Macs, and that it hired a top executive away from Amazon to make it happen. The question in the minds of many who follow the American e-book market is simple: Why?

The e-book market has stalled. Back in 2013, e-books were predicted to exceed print books in sales by now. But instead, according to Nielsen data, 2013 turned out to be the peak year for e-book sales, and the market has declined slowly ever since. 2016 figures from AuthorEarnings suggest that unit sales of trade e-books (that is, the kinds of books you'd buy at a retail store, as opposed to a college textbook, medical treatise, etc.) have settled down just above 20% of overall trade book sales.

That number probably underestimates the real total somewhat; for example, it doesn't include titles published through Amazon's own imprints, which are likely to sell proportionately more as e-books than in print. But it's fair to say that e-books are not doing to books what digital has done to music, where the converse is true: physical products (including CDs) currently represent just over 20% of recorded music revenue.

Meanwhile, Amazon has cemented its dominance of the American e-book market: as of early last year, its share was 83% by unit volume, up from 74% in 2015. Apple's market share has shrunk from just above 10% in 2015 to just below it last year.

And Kobo's share is virtually nil. It is now very difficult to find a U.S. retailer that carries Kobo's e-reader devices, though one can buy their e-books online and read them on their mobile apps and PCs. Elsewhere in the world, Kobo is a strong player; for example it's second only to Amazon in its native Canada as well as in France, with about a quarter of the market in both countries.

The fact is, the U.S. e-book market has been a sleepy place over the past few years. Innovations such as monthly subscription services and "P+E bundling" (buy a print book, get the e-book version for free or at a discount) haven't caught on, mainly due to lack of publisher support because their contracts with authors limit their flexibility to do the licensing deals.

So why are Walmart and Apple taking significant steps to invest in e-books?

For Apple, it's not so much about e-books per se as it is about keeping Apple's panoply of content offerings up to date. The planned changes are mainly user experience facelifts to bring iBooks -- which will be renamed simply Books -- into line with newer services such as the latest version of the iOS App Store and Apple Music, Apple's subscription streaming service that competes with Spotify, Google Play, and others. E-books are one piece of an overall operating platform, which nowadays is expected to include a range of content services; upgrading individual services like e-books is therefore analogous to a desktop operating system improving its backup utility or anti-malware service.

The Kobo deal with Walmart is more interesting. It's actually a small part of a much bigger deal that partners the massive global brick-and-mortar footprint of Walmart with a Japanese company -- Raukten, Kobo's parent since 2012 -- that is a global leader in e-commerce, even though it's relatively unknown in the U.S.

The partnership should take many forms in the years to come, as the companies find ways to collaborate to compete with Amazon online; but initially it has two manifestations. One of these is an online grocery service that the two companies will launch in Japan, to replace an existing service that Walmart currently operates under the Seiyu brand. Rakuten will contribute its major network of fulfillment centers to the arrangement.

The other is the deal with Kobo to sell e-books, digital audiobooks, and e-book readers in the U.S. On a basic level, this gives Kobo a simple way of re-entering the U.S. market in one step without having to build a network of retailers. Kobo had an arrangement with Borders, the bookstore chain that went bankrupt in 2011; after that, it tried to build up a network of indie bookstores, but that proved too difficult.

For Walmart, the Kobo ecosystem enables it to "check the e-book box," to make it more competitive with Amazon, Apple, and Google alongside its existing Vudu digital movie and TV platform. (Walmart doesn't have a digital music offering; maybe that's next.)

Source: theverge