3012

3012

2017-03-10

2017-03-10

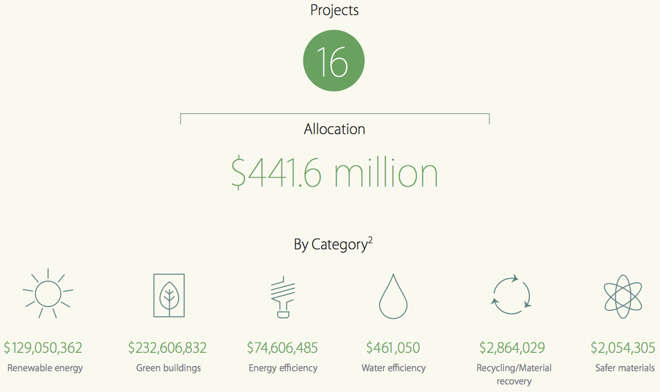

Apple's Green Bonds funded $441.5 million of environmental safety, conservation, climate change action in 2016.

Last February, Apple issued its first Green Bond, a $1.5 billion vehicle for investors seeking to put their capital to work on projects that will reduce the global human impact on climate change, help develop technology products using safer materials and work to conserve scarce resources. The company has now reported on a series of projects financed by those bonds last year.

Like Apple's other bond offerings issued in the U.S. and across other markets globally, the Green Bonds are a way to borrow money from investors seeking to limit their investment risk by accepting paper issued by a reputable company. They differ in that the Green Bond offering is committed to allocating funds for use in environmental projects.

By borrowing money in the form of a bond, Apple can gain access to capital without repatriating its funds held overseas, avoiding a high tax it otherwise isn't required to pay. Bonds also enable the company to write off the interest it pays to bond holders.

Across Apple's 2016 fiscal year that ended last September, the company reported having allocated an initial $441.5 million of Green Bond funds across 16 major projects. Those projects are projected to result in 127 megawatts of new renewable energy production; savings of more than 20 million gallons of water; diversion of 6,670 metric tons of waste from landfills; and the annual elimination of 191,500 metric tons of carbon dioxide emissions.

Apple's new data center in Mesa, Arizona, built in a facility originally designed to produce sapphire before the supplier collapsed in bankruptcy, will use Green Bond to fund a "utility-scale" 50MW solar array in Florence, Arizona. It will provide up to 151,000,000 kWh hours of electricity for the site annually, compatible to the annual energy use of 12,000 homes. The solar facility is expected to keep nearly 80,000 metric tons of carbon dioxide out of the atmosphere each year.

Source: appleinsider