3668

3668

2019-08-05

2019-08-05

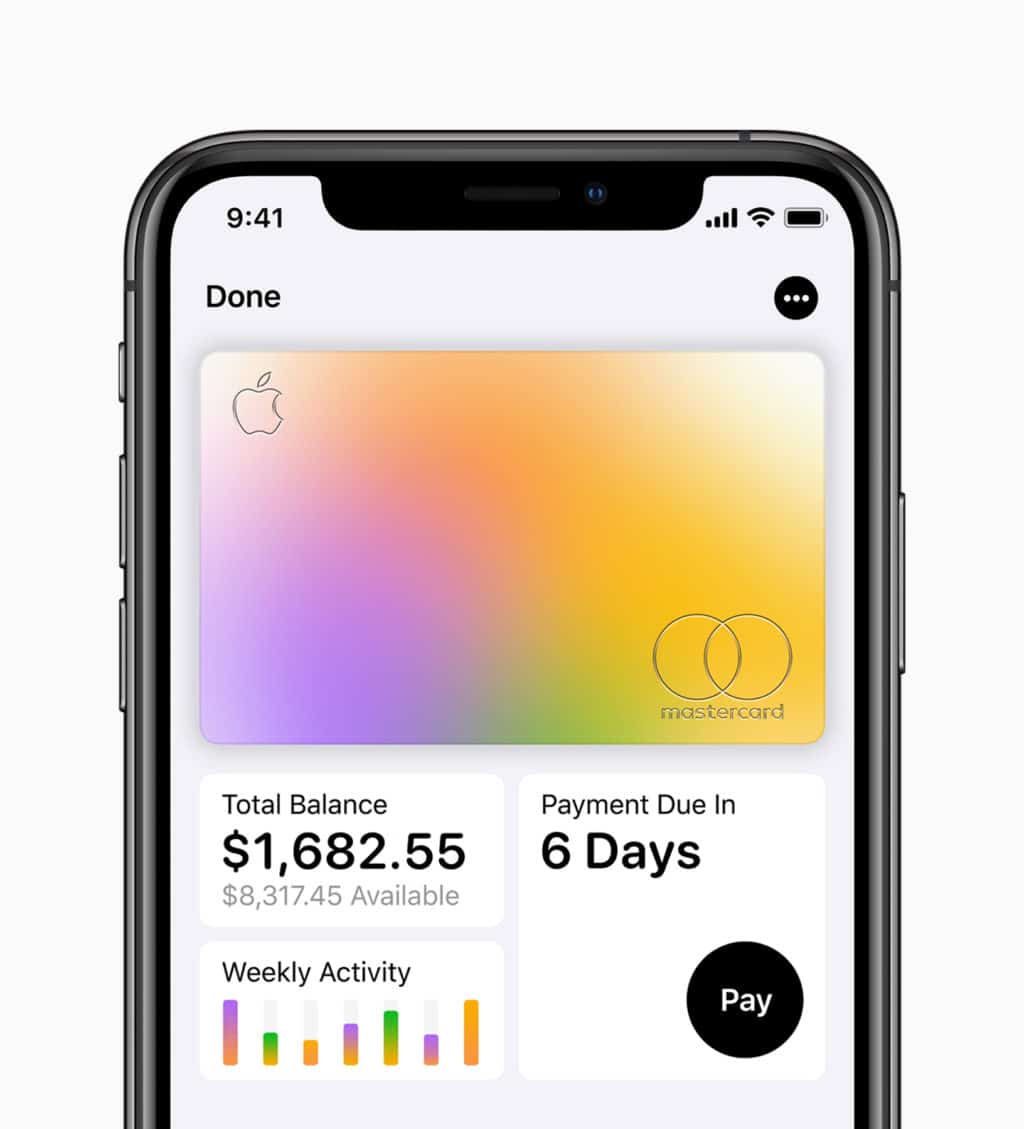

Ahead of the launch of the Apple Card, Goldman Sachs has uploaded the terms and conditions of the card on its website.

The Customer Agreement doesn’t really reveal anything that we did not already know. It makes it clear that there will be no fees whatsoever with the Apple Card, be it an annual fee, transaction fees, penalty fees, or others.

Apple Card’s due date will be 28 days from the close of each billing cycle. If a user ends up paying their entire balance within the due date, Goldman Sachs will not charge them any interest.

The agreement also prohibits the use of Apple Card on jailbroken iPhones. There is no iOS 12.4 jailbreak available yet but even if it does become available in the future, you will have to decide between it and using the Apple Card.

Apple and Goldman Sachs can close or limit your account if they find out you are not using an Eligible Device for Apple Card.

If you make unauthorized modifications to your Eligible Device, such as by disabling hardware or software controls (for example, through a process sometimes referred to as “jailbreaking”), your Eligible Device may no longer be eligible to access or manage your Account. You acknowledge that use of a modified Eligible Device in connection with your Account is expressly prohibited, constitutes a violation of this Agreement, and could result in our denying or limiting your access to or closing your Account as well as any other remedies available to us under this Agreement.

Additionally, the terms and conditions prohibit one from using Apple Card to purchase cryptocurrencies, casino chips, lottery tickets, and other similar items. This is in line with other cards as well which do not allow users to purchase cryptocurrencies from their card.

Apple’s CEO Tim Cook had confirmed that Apple Card will launch in August. Most likely we will see the service go live for iPhone users next week.

Source: iphonehacks