3516

3516

2017-06-29

2017-06-29

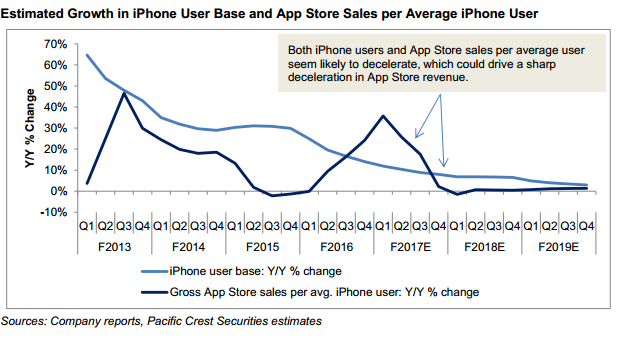

Services revenues are a relatively concentrated profit center and says it is likely there will be a meaningful deceleration going forward.

"A breakdown of Apple's Services revenue highlights the relatively concentrated nature of profits within the segment and a likelihood for meaningful deceleration going forward, which suggests it is not a panacea for slower iPhone growth beyond FY18."

App Store is the key segment within Services and it is likely peaking. He expects growth of 32% in FY 2017 and expects the App Store to generate more than half of the Services profits. He sales App Store sales per iPhone user appears likely to decelerate and when coupled with a slow down in iPhone user growth will likely be the source for a significant decline in the pace of growth going forward.

FY 2017 EPS estimate remains at $8.86 and FY 2018 EPS estimate remains at $10.53.

Source: streetinsider