2143

2143

2017-11-10

2017-11-10

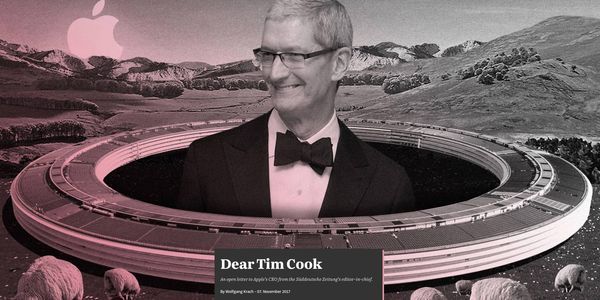

The editor in chief of Germany’s biggest newspaper, Süddeutsche Zeitung, has written an open letter to Apple CEO Tim Cook in which he claims that Apple pays ‘between 1 and 7 percent’ tax on its overseas income.

Wolfgang Krach says the numbers were reached by its analysis of the so-called paradise papers, a massive leak of financial records relating to offshore holdings in countries commonly used as tax havens. He attacks Apple for ‘shirking’ its tax obligations and for failing to answer questions put by the paper …

Krach praises Apple’s products, but says there is a disconnect between the company’s public stance and its private behavior.

The letter says that the paper is most concerned about Apple seeking ‘official assurance of tax exemption’ from an unspecified country.

Apple has said that its ‘effective’ overseas tax rate is 21%. Neither Apple nor Süddeutsche Zeitung have explained the basis for their respective calculations.

But the latest development in the saga underlines the point I made yesterday. This controversy isn’t going to go away anytime soon, and Apple’s best response is to ensure that it not only lives up to its moral stance by refraining from unusual tax avoidance measures, but is sufficiently transparent in its financial dealings that there can be no appearance of underhand action.

Source: 9to5mac