2415

2415

2017-07-07

2017-07-07

The Apple iPhone is 10 years old. The device not only turned Apple into one of the world's most valuable companies, helping to boost its stock price more than 700%, it also changed the way we invest and trade stocks.

Before the first iPhone went on sale, Apple had gotten good at building computers and making iPods. But in the early 2000s, engineers at Apple had started working on something entirely new — a mobile device that combined a phone, an iPod and a computer.

Everything about the iPhone was Apple’s: the phone itself, the design, the operating system. The only thing Apple needed was a network that allowed users to talk, text and browse the Internet. Enter AT&T's mobile services company, formerly known as Cingular Wireless.

Apple and the wireless carrier struck a deal before the iPhone was first announced at the Macworld Conference in January 2007. The company would be the iPhone’s exclusive carrier. But the agreement was a risk. The carrier was concerned about becoming a dumb pipe, or a mere conduit for a data and minutes, instead of company that could also provide services and applications on top of its network, said Raj Aggarwal, a consultant on the deal for Apple.

Verizon turned down a similar offer from Apple, USA Today reported at the time.

“Cingular was not the No. 1 network at time, so they were much more open and comfortable with having a phone on their network like the iPhone,” Aggarwal said. “They thought they could use it as a way to gain market share in the long-run even if they were giving things up.”

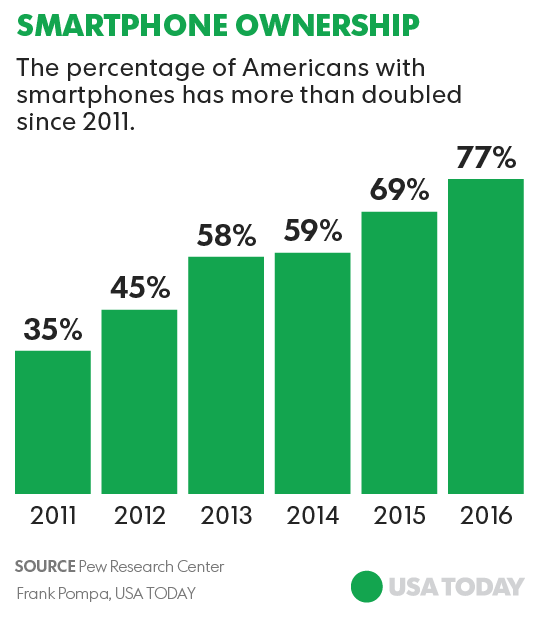

AT&T is now the No. 2 wireless carrier, behind Verizon Wireless. Its deal with Apple would start a fundamental shift for cell phone companies. Increasingly, consumers' brand loyalty is now to the platform or the manufacturer, such as Apple, Google or Samsung. At the same time, carriers were forced to beef up their networks to support the increased data needs of the smartphone boom. As a result, experts say, the wireless industry is becoming increasingly commoditized, meaning there is little difference between what each carrier offers.

“They (carriers) were downgraded to just infrastructure providers while others were benefiting from the next wave of growth. The iPhone really played the key role there because that was really a game changer, putting a computer into everyone’s pocket,” said Florian Gröne, an analyst at PricewaterhouseCoopers who studies the telecommunications industry.

Before the advent of the iPhone, if someone wanted to buy a cell phone, he or she would go to the carrier first. The phone itself — and who made it — didn’t matter as much as the service it ran on. The quality of the network mattered in the early days, and there was pent-up demand for a Verizon iPhone that became available in 2011. As it grew in market share, the iPhone shook up this dynamic, creating high demand for Apple’s iPhone instead of a phone on AT&T or a phone on Verizon.

“The iPhone certainly made the brand matter. It sort of went from the carrier was in control to you deciding what device you wanted or what carrier you would move to so you could get that device,” said Chris Silva, an analyst at Gartner who focuses on the telecommunications industry.

The iPhone sparked a significant increase in mobile Internet browsing and streaming. The surge in data usage forced carriers to invest in more widespread, faster networks. Since Apple controlled the user interface, the App Store, pricing, distribution and branding of the iPhone — all of which were given up in the original AT&T deal — there wasn’t much left for the carriers besides the network, said Gröne.

Now, nearly all wireless companies have comparable coverage across the country. And as a result, the fear carriers had about becoming a dumb pipe a decade ago is, in a sense, coming to pass, experts say.

“In the early days, it was about who had the best network or who had the best coverage in your area,” said Gröne. “These days it's more of a given and everyone has wall-to-wall coverage and it becomes more of a commodity or a utility. People go for the most attractive device or the ecosystem.”

So wireless companies are pulling out the stops to differentiate their offerings. They're competing hard on price, plan structure and content.

T-Mobile, for example, literally gives away free stuff, such as discounts on movie tickets and free vacations, each week during their promotional program T-Mobile Tuesdays. The bigger companies have been part of merging with other media companies to bundle wireless, TV and Internet services, hence AT&T's $85.4 billion deal to buy Time Warner, and Verizon's $4.5 billion deal for Yahoo. And all carriers undertake aggressive marketing campaigns aimed at reigniting the brand loyalty that has been lost over the last ten years.

“It’s not about the data, it’s not about the call quality. The networks are largely comparable these days, but it’s about the unique features these carriers can provide and that’s new,” said Silva.

Source: USA Today