2762

2762

2017-11-01

2017-11-01

It's iPhone X launch week -- the high-dollar mobile device gets released to consumers on Friday. And Wall Street is starting to realize that consumer demand could be higher than expected for the next-gen iPhone. According to Piper Jaffray's Michael Olson, a small survey showed that 50% of iPhone owners surveyed plan to upgrade their phones this year, vs. 35% a year ago.

That potentially big boost in demand for the iPhone 8 and iPhone X could translate into substantial unit growth -- and even bigger sales growth, considering iPhone X's much higher average selling price compared to prior models.

Likewise, Apple's rumor mill is in full swing Tuesday, as reports come out that Apple is working on iPhone and iPad designs that don't use components from Qualcomm, who Apple is actively battling in a patent dispute.

It all comes back down to the price action: Apple is definitively in breakout-mode right now. And that clears the way to even more upside as we barrel toward the final stretch of 2017.

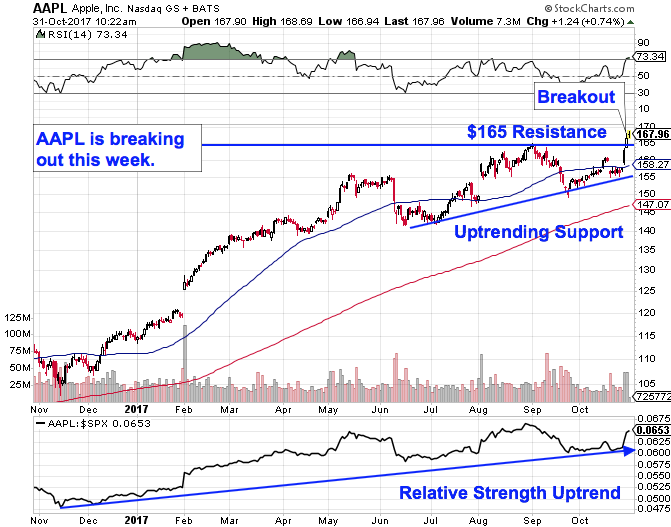

To figure out how to trade it, we're taking a technical look at Apple's chart:

After rallying hard at the start of the year, Apple spent the last several months consolidating sideways in a bullish continuation pattern that's only just now breaking out this week. The breakout here is our indication that buyers are still squarely in control of Apple's share price, despite the fact that AAPL is 45% higher than it started the year.

The price setup in Apple is an ascending triangle pattern, a price setup that's formed by horizontal resistance up above shares at $165 and uptrending support to the downside. Basically, as Apple has pinballed in between those two technically important price levels, it's been getting squeezed closer and closer to $165 breakout territory, culminating in this week's move higher.

Relative strength, the side-indicator down at the bottom of Apple's price chart, adds some extra confidence to the upside in this stock. The fact that relative strength continues to be in an uptrend of its own is a signal that shares are statistically predisposed to continue outperforming into year-end.

If you don't already own Apple, now's as good a time as any to pull the trigger on this tech giant. Buyers have just confirmed that they're still in control here.

Source: thestreet